Congestion and capacity signals guide early 2026 ocean planning

Published: Thursday, January 08, 2026 | 12:00 am CDT

Onthispage

The Trans-Pacific ocean market is entering January with a mix of seasonal peaks and structural dynamics. Imports into the United States are expected to rise ahead of the Lunar New Year on February 15, as shippers accelerate cargo before factories shut down for the holiday. This short, intense surge will create temporary demand around ports for drayage, inland trucking, and regional distribution, while imports from other global regions are projected to remain flat unless tariffs change.

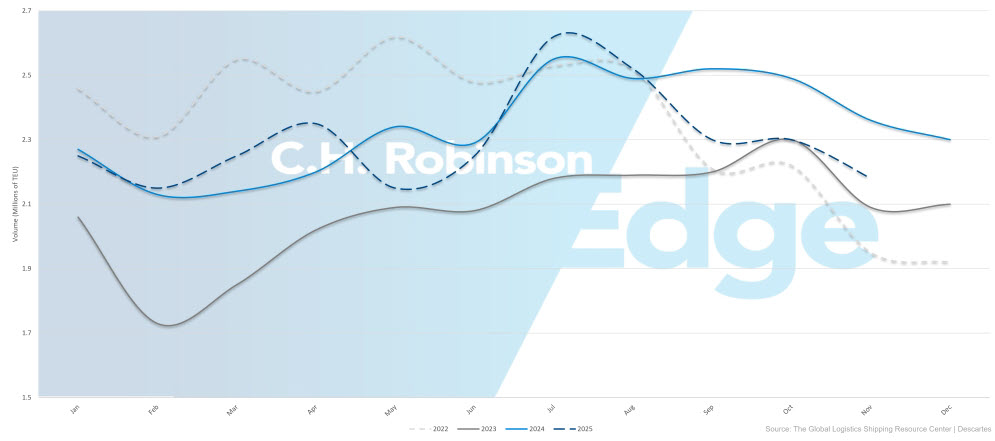

U.S. import volumes show modest improvement: November fell 11.6% year over year, better than the previously forecasted 19.7% decline, and December fell 12.7%. Full-year 2025 imports are projected at 25.2 million twenty-foot equivalent units (TEUs), down just 1.4% from 2024.

January is expected to mark the first month-over-month (m/m) import increase in six months, though with volumes remaining below last year’s levels. Globally, ocean demand growth is forecast at only 1-2% in 2026, while carriers continue using blank sailings and selective service adjustments to manage excess fleet capacity. A weaker U.S. dollar and the absence of counter-tariffs on U.S. goods continue to support steady export demand.

2022-2025 U.S. Container Import Volumes (TEUs)

Any broader resumption of Suez Canal services remains contingent on a sustained Middle East cease-fire and reduced war-risk insurance costs. CMA CGM plans to restart select Suez services in January, while other carriers have yet to confirm participation.

Overcapacity in the global container fleet—combined with reopening of the Suez Canal and minimal vessel scrapping relative to fleet growth—suggests that the market is unlikely to see sustained pressure beyond this pre-holiday spike. Carriers may implement blank sailings or service adjustments, but these measures are costly and unlikely to materially shift conditions in the short term.

These ocean dynamics are feeding into domestic U.S. truckload conditions. Recent winter tightness in the domestic trucking market appears tied to seasonality, weather, and equipment and driver availability rather than sustained demand increases. Even as pre–Lunar New Year imports temporarily elevate activity at ports, internal and external indicators show overall domestic freight demand remains relatively flat.

This suggests that, as domestic trucking capacity continues to decrease, inland trucking pressure is driven more by the timing and concentration of shipments than by a broad market shift.

Shippers should plan proactively for the pre–Lunar New Year import surge, secure space early, and monitor both ocean and inland capacity. The pre-Lunar New Year surge, taken together with a domestic freight market experiencing elevated rate sensitivity, could make for an interesting month before the slack period of imports begins in mid-February. For a deeper understanding of the current state of domestic trucking, see the Truckload section of this report.

Asia

Regional highlights

Asia to North America

Forecast: Soft demand is expected to persist through January and into early 2026. Carriers continue to maintain blank sailing programs to balance capacity with market conditions. Spot rates may see limited increases in January, particularly on U.S. West Coast (USWC) lanes, driven by pre–Lunar New Year booking activity. U.S. East Coast (USEC) rates remain softer, though targeted blank sailings should help support pricing stability.

Market dynamics: Weak demand reflects ongoing trade uncertainty and continued inventory normalization by U.S. importers following earlier front-loading. Congestion at Singapore and other Southeast Asian transshipment hubs continues to extend transit times for cargo requiring onward movement, driven by vessel bunching, infrastructure limitations, and spillover from Red Sea diversions. Direct shipments to North Asia face fewer operational constraints.

Looking ahead, Premier Alliance plans to expand Pacific Southwest capacity by approximately 20% in April 2026, a development that could influence spot rates and slot availability over the medium term.

Asia to Europe

Forecast: Market conditions are expected to remain generally stable through January, though schedule reliability will continue to be challenged by congestion at European ports and transshipment hubs. CMA CGM plans to resume select Suez Canal services in January; however, a broader carrier return remains uncertain. Strong capacity utilization and pre–Lunar New Year demand are expected to keep spot rates on an upward trajectory through mid-January, with tighter booking requirements in place.

Market dynamics: Red Sea security concerns continue to reroute vessels around Africa, effectively removing roughly 10% of global capacity as longer voyages reduce annual sailing frequency. Persistent congestion at major European ports—including Antwerp, Hamburg, and Rotterdam—slows vessel turnaround, while bottlenecks at Asian transshipment hubs such as Singapore further disrupt schedules.

Any sustained improvement in capacity and transit times depends on a lasting cease-fire in the Middle East and lower war-risk insurance premiums. CMA CGM’s phased Suez resumption marks the first major carrier commitment and is being managed cautiously to avoid renewed congestion.

Key takeaways

Shippers moving cargo from Asia to the United States should plan closely around blank sailing schedules, with early bookings and proactive communication critical through January. For Europe-bound cargo, expect extended transit times and monitor carrier announcements related to the Suez Canal, as broader resumption of shipping through the channel could materially improve capacity and transit reliability later in 2026.

North America

Regional highlights

North America to Asia

Forecast: Demand remains soft, resulting in minor capacity adjustments. Space is generally available, though cargo requiring transshipment through congested Southeast Asian hubs continues to face tighter conditions.

Market dynamics: Export volumes remain subdued as overseas inventories stay largely replenished. Congestion at major hubs, particularly Singapore, continues to extend transit times for transshipped cargo, while direct shipments to North Asia remain largely unaffected.

North America to Europe

Forecast: Capacity remains tight from U.S. Gulf Coast (USGC) origins, while the USEC offers comparatively better availability. European port congestion will continue to affect schedule reliability, and rates are expected to hold through January, supported by EU Emissions Trading System increases effective January 1.

Market dynamics: Ongoing congestion at European ports continues to slow vessel turnaround, reducing effective capacity. A strong euro keeps U.S. exports relatively expensive, moderating demand. Service adjustments by the Gemini Cooperation (Maersk and Hapag-Lloyd) are aimed at improving cross-border connectivity. Direct shipments to major European hubs face fewer constraints than those requiring transshipment.

North America to South Asia, Middle East, Africa (SAMA)

Forecast: Carrier options serving the Middle East and Indian subcontinent have expanded beyond Mediterranean Shipping Company (MSC) and CMA CGM, though these two carriers continue to offer the most comprehensive coverage. Space availability has improved to India, while Bangladesh and Pakistan remain tighter, with most carriers reliant on transshipment. Major hubs—including West Mediterranean ports, Jebel Ali, Abu Dhabi, Mundra, and Colombo—remain congested, creating ongoing scheduling challenges.

Rates remain elevated but are showing early signs of easing as additional carrier options enter the market. Meaningful reductions are unlikely until Suez Canal operations resume. CMA CGM plans to restart Suez Canal services in January 2026 with its Indamex service from India to the USEC, along with select Europe-bound services. Blank sailings, particularly on U.S.-bound lanes, continue to affect schedule planning and space availability.

Market dynamics: Structural constraints continue to limit effective capacity and extend transit times. While expanded carrier participation provides more competitive options, reliance on indirect services and ongoing blank sailings adds uncertainty and reinforces the need for careful planning. Space to India benefits from moderate demand and increased carrier focus, while Bangladesh and Pakistan remain constrained due to limited direct services and hub congestion. Elevated rates reflect these structural challenges, longer routings tied to the Suez closure, and continued uncertainty around normalization timelines.

Carriers including Ocean Network Express (ONE), Orient Overseas Container Line (OOCL), and Hapag-Lloyd appear to be positioning for growth on these lanes once Suez Canal routing resumes in 2026.

North America to South America

Forecast: The market remains in peak season, with generally reliable service and competitive space availability. CMA CGM, Cosco, and ZIM report schedule reliability of 86% or higher. Port and vessel space is open for January bookings, though peak-season surcharges apply on select lanes, particularly to Caribbean destinations.

Market dynamics: Strong consumer demand and restocking activity continue to support peak-season volumes on South American and Caribbean lanes. Unlike other trades experiencing softer demand, volumes here remain resilient.

Indirect services requiring transshipment can still face delays, extending overall transit times. Overall reliability and pricing have improved significantly compared with recent years, creating favorable conditions for shippers. The planned discontinuation of Hapag-Lloyd’s CES service in 2026 may impact connections from St. John, New Brunswick, to South America, potentially requiring more indirect routings.

Geopolitical developments in Venezuela led to brief operational disruptions in select Caribbean ports and transshipment hubs in early January. Some shippers experienced minor delays tied to port congestion and schedule adjustments, but services had largely normalized at the time of this report’s publication.

North America to Oceania

Forecast: Space from USWC origins remains moderately tight due to structural blank sailings, though overall capacity is sufficient and rates remain competitive. Cargo destined for New Zealand continues to require fumigation at origin, based on vessel on-board dates starting September 1, 2025, to comply with brown marmorated stink bug regulations.

Market dynamics: Post-peak softness across Oceania markets is driving these conditions. USWC space constraints are structural in nature, tied to service design and blank sailings rather than demand strength. Looking ahead, MSC’s Eagle Service from the USEC, launching in March 2026, will add a third direct service option, increasing capacity and routing flexibility.

Key takeaways

North American exporters should prioritize early booking and proactive planning across all major trade lanes to secure space and mitigate the impact of blank sailings and port congestion. For Europe-bound cargo, diversifying destination ports can help avoid the most congested gateways, with USEC origins generally offering better availability than USGC origins.

Shipping to Asia requires close coordination around blank sailing schedules, with advance booking especially critical for Southeast Asian destinations. South America and Caribbean lanes continue to offer attractive opportunities, supported by improved reliability and competitive pricing. For the Middle East and India, early booking and strategic use of expanded carrier options can help optimize service quality and cost.

Europe

The region continues to face significant port congestion, reducing effective capacity and impacting schedule reliability. Container and chassis shortages persist throughout the European hinterland, driven by congestion and ongoing driver shortages. Despite these constraints, the market is expected to remain relatively stable through January, with both rates and space likely to hold. Rate increases announced by liners from Mediterranean origins may not fully materialize unless additional congestion or blank sailings further tighten conditions.

Regional highlights

Europe to North America

Forecast: The market is expected to remain relatively stable through January despite the potential for overcapacity. Rates and space are likely to hold at current levels, with increases from Mediterranean origins unlikely to convert unless congestion worsens or additional blank sailings are introduced. Schedule reliability continues to be affected by ongoing port congestion across Europe.

Market dynamics: Congestion at major European ports—particularly Antwerp, Hamburg, and Rotterdam—continues to create ripple effects throughout the supply chain. Delays prevent vessels from returning to Europe as scheduled, reducing the effective cargo-carrying capacity available to exporters.

Container and chassis shortages in the hinterland are compounded as equipment becomes trapped inland, while driver shortages further hinder repositioning. A strong euro versus the U.S. dollar dampens export competitiveness, keeping volumes moderate, while uncertainty around U.S. tariff policy encourages exporters to remain cautious with shipment volumes.

Key takeaways

European shippers moving cargo to North America should plan for ongoing schedule disruption related to port congestion and build additional buffer time into supply chain planning. Early booking, combined with flexibility and backup routing options, can help mitigate delay risk. Shippers should also monitor currency fluctuations and trade policy developments, as both may present shifting opportunities or challenges in the months ahead.

South Asia, Middle East, Africa (SAMA)

Ocean freight exports from India subcontinent continue to face divergent conditions depending on destination market. Trade to North America remains under pressure from U.S. tariffs of up to 50%, which are dampening demand and placing downward pressure on rates. Additional headwinds have emerged as Mexico imposed tariff increases of up to 50% on imports from India starting January 1, impacting approximately $2 billion in exports across sectors including automobiles, auto parts, textiles, iron and steel, plastics, and leather goods.

In contrast, trade from the India subcontinent to Europe remains comparatively stable. CMA CGM’s announcement to resume its Indamex service via the Suez Canal in January 2026 represents a meaningful positive development, improving transit times and adding effective capacity to the market.

Regional highlights

SAMA to North America

Forecast: January rate levels are expected to remain largely stable, with the potential for modest downward adjustments. Space and capacity are available across major India subcontinent lanes, and equipment remains readily accessible at ports and inland container depots. General rate increases and peak-season surcharges initially planned for January 1 have been deferred to January 15. Carriers may attempt partial or full increases later in the month should demand show measurable improvement.

Market dynamics: Export demand from India to North America remains subdued, driven primarily by U.S. tariffs that continue to suppress volumes and limit carriers’ ability to implement rate increases. The decision to delay January rate adjustments reflects a market where capacity exceeds demand. Additional pressure stems from Mexico’s new tariffs on key Indian export categories. While India is pursuing a preferential trade agreement with Mexico, uncertainty around timing and outcomes is likely to keep near-term demand constrained.

SAMA to Europe

Forecast: Demand from the India subcontinent to North Europe and the Mediterranean is expected to remain steady through January. Service levels should remain consistent, with ample space available across most sailings. Rates are largely stable, with carriers offering spot pricing on select departures and remaining open to long-term annual agreements to secure committed volumes.

Market dynamics: This trade lane remains relatively balanced, supporting steady demand and stable rates. A key development is CMA CGM’s planned resumption of the Indamex service via the Suez Canal for both eastbound and westbound voyages, which would materially shorten transit times compared with routings around Africa. The Suez route reduces each voyage by approximately 6,000 nautical miles—cutting transit times by roughly two weeks—and effectively adds capacity by enabling vessels to complete more rotations annually.

Carriers are offering spot opportunities and remaining receptive to annual contracts as they prioritize predictable cargo flows and long-term planning over short-term rate increases. Continued uncertainty around routing and trade policy reinforces the value of committed volumes in this market environment.

Key takeaways

For North America-bound shipments, exporters should monitor the January 15 timeframe when deferred rate increases may be implemented, though current conditions suggest rates will remain relatively stable. Space and equipment availability provide flexibility for near-term bookings. Exporters shipping to Mexico should assess the impact of the new tariffs on their specific products and closely track India’s trade negotiations, as any agreement could alter tariff exposure and demand outlooks.

For Europe-bound cargo, exporters can take advantage of current spot opportunities and consider long-term annual agreements to secure rate stability through 2026. Shippers should closely monitor CMA CGM’s return of the Indamex service via the Suez Canal, which is expected to materially shorten transit times and improve overall service reliability.

The contrast between pressured North American demand and stable European demand highlights the importance of market diversification. Where feasible, exporters may benefit from shifting volumes toward Europe to reduce exposure to tariff-impacted U.S. lanes.

South America

Conditions for South American ocean exports vary by coast as the market moves into January 2026. East Coast markets continue to face significant trade policy impacts, particularly from 50% U.S. tariffs on key commodities such as sugar, prompting exporters to diversify toward Europe and other destinations. Despite these challenges, major Brazilian ports continue to demonstrate generally strong operational performance.

West Coast markets—including Chile, Colombia, and Peru—are experiencing moderate rate volatility, with pricing under pressure due to ample vessel capacity despite steady seasonal agricultural export flows. A key planning consideration for Asia-bound cargo is the mid-February overlap of Lunar New Year (February 15–23) and Brazil’s Carnival (February 16–17), when Chinese factories and Brazilian businesses close simultaneously.

Regional highlights

South America to Asia

Forecast: Vessel space remains readily available through January, with carriers actively seeking cargo. The overlap of Lunar New Year and Brazil’s Carnival in mid-February will compress booking windows, requiring advance planning to avoid shipment delays.

Market dynamics: Excess capacity continues to suppress rates on this trade lane, leading carriers to prioritize 40-foot containers, which generate higher revenue per vessel slot than 20-foot units. The Lunar New Year–Carnival overlap creates a brief but critical disruption, limiting booking and processing activity. When operations resume, backlogs are likely, increasing the risk of delays for unplanned shipments.

Separately, Brazil’s government is evaluating potential tariff increases on steel imports from China in 2026 to protect domestic producers. While no final decisions have been made, any policy change could influence future cargo volumes and equipment positioning.

South America to North America

Forecast: Transshipment flows via Cartagena, Kingston, and Panama are expected to remain generally smooth through January, with only minor delays when vessels arrive outside scheduled windows. Booking success is higher for shippers that meet carrier volume commitments. Availability of 20-foot containers remains critically constrained and is expected to continue limiting certain export movements.

Market dynamics: Brazilian exports continue to feel the impact of U.S. tariffs, accelerating diversification into alternative markets across Asia and the Middle East. The effect is most pronounced in sugar, where U.S.-bound volumes have declined by more than 80%.

Equipment imbalance remains a challenge: imports predominantly arrive in 40-foot containers, while key export commodities—such as wood, tile, and sugar—require 20-foot containers. This mismatch keeps availability extremely tight despite competitive pricing. Maersk’s Conosur service, operated with Hapag-Lloyd, completed its terminal transition to DP World Santos on January 5, 2026, which may improve operational consistency. Coffee exports to the United States continue after tariffs were removed in November, highlighting the resilience of this trade even as overall volumes trend lower.

South America to Europe

Forecast: Space is expected to remain severely constrained through January, with no near-term relief anticipated. Shippers should plan bookings at least four weeks in advance, as overbooking is already resulting in rolled cargo. Demand for special cargo—including oversized, project, and high-value shipments—is expected to increase, driven primarily by strong coffee and tobacco exports.

Market dynamics: Tight capacity is being driven by sustained agricultural export demand, particularly from European buyers sourcing Brazilian products. To manage congestion at the London gateway, CMA CGM, MSC, and ONE have extended services to Southampton, providing alternative routing options. Other carriers continue to call at the London gateway without restriction.

The previous 50% U.S. tariff on Brazilian coffee had shifted some volumes toward Europe, increasing exports to destinations such as Germany and Italy. While overall export volumes are easing, higher per-unit pricing is supporting total revenue. Tobacco season is adding further pressure, with carriers favoring 40-foot dry containers following the sugar season. In this environment, negotiating extended free time is critical, as demurrage and detention costs can quickly erode margins.

Key takeaways

South American East Coast (SAEC) exporters face a capacity-constrained European market, making bookings at least four weeks in advance essential. For Asia-bound cargo, planning should focus on the mid-February overlap of Lunar New Year and Brazil’s Carnival; February shipments should be completed by February 10 to avoid backlog risks.

U.S.-bound cargo remains challenged, prompting continued diversification into alternative markets. Coffee exporters can leverage strong European demand, though overall volumes are trending down. The shortage of 20-foot containers for exports such as wood and tile to North America requires creative solutions, including consolidating into 40-foot containers where feasible or sourcing from alternative origins with better equipment availability.

South America West Coast (SAWC) exporters should maintain booking flexibility and coordinate closely on equipment planning, particularly for refrigerated cargo during peak agricultural export periods when specialized equipment is limited.

Oceania

Export conditions across Oceania remain generally positive for January 2026, supported by improved space availability on several key services following the year-end peak. Seasonal agricultural demand—particularly for grain, pulses, wine, and protein—continues to underpin volumes, while carriers actively manage equipment and network balance to maintain reliable service.

Regional highlights

Oceania to Asia

Forecast: Services to North Asia remain broadly open through January, with space available for both dry and refrigerated cargo. Carriers are reviewing existing bookings and considering additional January volumes, particularly from Australia’s East Coast. Several services to Southeast Asia are also reopening following the end-of-year peak, with Brisbane offering strong access to both space and equipment.

Market dynamics: Improved availability reflects the release of December “cover bookings” that carriers held during the year-end peak to secure anticipated demand. As these bookings clear, capacity has reopened, giving exporters greater flexibility. Carriers are actively seeking January cargo, making early-month shipments preferable ahead of late-January Lunar New Year pressure. Brisbane continues to stand out as a reliable gateway, with less severe equipment imbalances than other Australian ports.

Oceania to North America

Forecast: Space on Trans-Pacific lanes remains selective through January, though conditions are expected to ease as new services come online in early 2026. Exporters should plan shipments early and remain flexible with routing, using regional shuttle services where needed for time-sensitive cargo.

Market dynamics: Limited space persists on Trans-Pacific lanes as steady U.S. demand for Oceania products keeps post-peak capacity tight. New services—including MSC’s Eagle Service from the USEC beginning in March 2026—will expand capacity and routing options, helping to relieve current constraints. Until then, exporters may rely on regional shuttles via hubs such as Singapore or Hong Kong, adding five to seven days to transit times but improving booking flexibility.

Oceania to Europe

Forecast: Booking momentum is increasing for grain, wine, and general cargo through January. Availability is improving across multiple services, with carriers open to reviewing spot shipments into early 2026.

Market dynamics: Strong agricultural demand—particularly grain and wine—is driving bookings to European destinations. Carriers have responded by repositioning or adding capacity in January to support the seasonal surge. European demand for Oceania wine remains robust, with Australian and New Zealand products maintaining a premium position despite broader economic uncertainty.

Oceania to SAMA

Forecast: Rising demand for Africa-bound exports is creating new opportunities through January and into Q1 2026. Availability is improving across multiple services, with carriers open to reviewing spot shipments.

Market dynamics: Oceania exporters are increasingly diversifying into African markets, driven by growing imports of food, building materials, and manufactured goods as these economies expand. This diversification reduces reliance on traditional European markets while supporting better equipment utilization and backhaul balance for carriers.

Oceania to Oceania (Trans-Tasman)

Forecast: Services remain stable following minor schedule adjustments over the holiday period. Trans-Tasman shuttles between Australia and New Zealand are operating reliably through January, with alternative routings via New Zealand available if needed.

Market dynamics: The Trans-Tasman trade continues to provide consistent service, reflecting its importance for consumer goods and manufacturing inputs. Alternative routings via New Zealand offer added flexibility for consolidation, onward connections, and schedule optimization.

Key takeaways

Oceania exporters should confirm January cargo readiness as early as possible to secure preferred sailings, particularly on Trans-Pacific lanes where space remains selective. Brisbane offers strong opportunities for January exports, with reliable access to both space and equipment for Asia-bound cargo.

Carriers have implemented one-roll booking policies for dry cargo without container assignment, meaning shipments that miss their booked sailing may only be rolled once before losing the booking. On-time delivery to port is therefore critical. Flexibility in routing and timing will remain essential through January as carriers continue to optimize post-peak networks. Where direct services are full, alternative routings via regional hubs—adding five to seven days to transit times—can provide guaranteed booking options.

Agricultural exporters should take advantage of improved availability to Europe, the Middle East, and Africa, with carriers remaining open to spot opportunities into Q1 2026. Africa-bound exports represent a growing diversification opportunity, while upcoming service launches—particularly MSC’s Eagle Service in March—should be monitored closely as they may add capacity and improve rate competitiveness later in the quarter.

Download slides

Download slides